| Implementation & Monitoring > Identification, Prioritization and Selection |

Stage 1:  Identification, Prioritization

Identification, Prioritization

and Selection

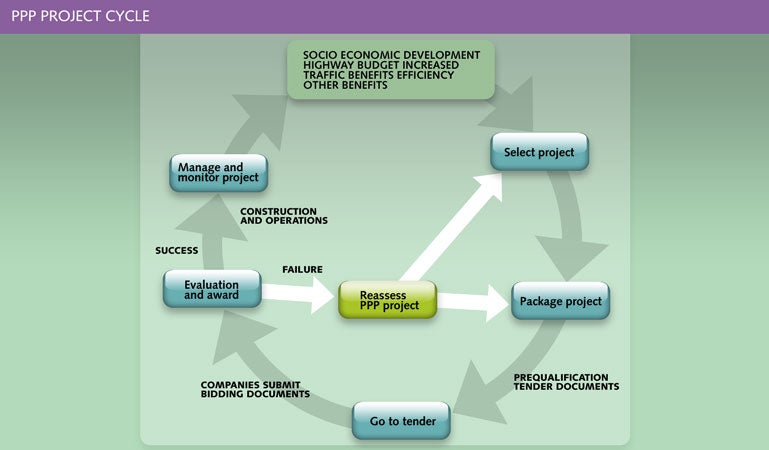

The PPP cycle

The following shows an indicative route through the implementation or project cycle. As discussed in Module 3, a long list of public sector projects is prepared to fulfill national/local infrastructure needs through a Needs Analysis usually within a National Plan, Sector program or other public sector identification process. This is the starting point for Module 5.

Stage 1:

Projects are identified, ranked and prioritized. The best projects will have the highest potential for PPP based on e.g. strong economic and social need, good financial viability with no or minor fiscal subsidy needed, risks are manageable and few major negative environmental and social impacts etc.

The most appropriate projects are selected for detailed FS type study.

Stage 2:

Contracting Authority carries out FS type study and successfully completes.

Optional: Line Ministry and PPP Cell(s) reviews adequacy of study.

Based on (i) if no fiscal support/subsidy needed, Contracting Authority tenders the project.

Or (ii) if fiscal support needed, Central PPP Cell/MOF/RMU assesses request, and socio-economic justification and fiscal support and suggests any modification (amount, type of subsidy etc.).

MOF/RMU assesses project according to fiscal space and project risk criteria, agrees on support and passes a project that meets its criteria back to the Contracting authority for implementation.

Stage 3:

Project is tendered.

PPP Cell(s) and MOF/RMU review to assess tenders that might impact on previous project approvals e.g. risk allocation changed etc.

Stage 4:

Private party is procured with or without negotiation.

Assuming no significant changes at time of procurement/negotiation (Stages 3/4), project proceeds to contract signing.

Financial Close; Financing both equity and debt is available and committed.

Stage 5:

Contract management (Stage 5a) starts its first phase (between contract signing and construction start up).

Contract management (Stage 5b) for construction and operation stages.

The following figure shows the normal PPP cycle. This shows the main path of a project assuming no or few problems. However, there will likely be loops and feedbacks assuming various types of issues that may arise within the PPP cycle. The figure includes a loopback in the case of initial tender failure. Usually, tender failure results from weak project preparation or unacceptable concession terms or both. Very occasionally there is tender failure because the project is just not appropriate for PPP and should be returned to the Public Procurement program.

General references that apply to the overall PPP project cycle and each of the five stages are listed below.

![]() PPP/PFI Guidance, Department for Transport, 2009

PPP/PFI Guidance, Department for Transport, 2009

![]() Value for Money Assessment Guidance ; UK Treasury, PFI; 2006

Value for Money Assessment Guidance ; UK Treasury, PFI; 2006

![]() Getting Value for Money from Procurement - How Auditors can Help; UK National Audit Office, 2001

Getting Value for Money from Procurement - How Auditors can Help; UK National Audit Office, 2001

![]() Standardisation of PFI Contracts; Version 4, UK Treasury; 2007

Standardisation of PFI Contracts; Version 4, UK Treasury; 2007

![]() Guidelines for Successful Public-Private Partnerships; European Union, 2003

Guidelines for Successful Public-Private Partnerships; European Union, 2003