| Overview & Diagnosis > Enabling PPPs | Public Sector Reform |

Enabling environment for PPP

Enabling environment for PPP

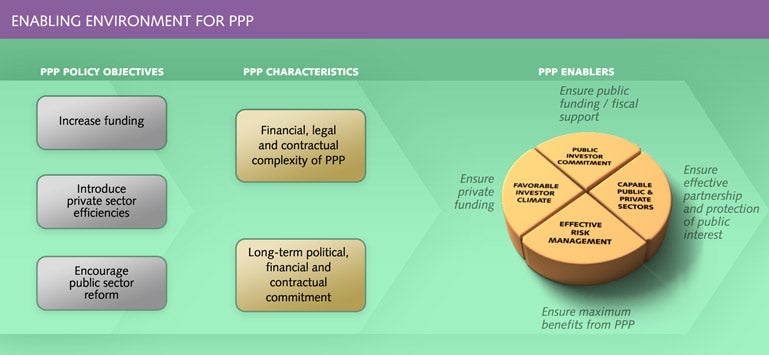

Worldwide experience has demonstrated that the successful implementation of a PPP program requires an enabling environment to be in place in order that PPP projects may be implemented effectively and with maximum benefit to the public sector.

The enabling environment is composed of four principal components, which the Toolkit terms enablers. These enablers are closely interlinked. A favorable investor climate will thus not create private investment by itself; the other enablers related to public commitment, risk management and public sector capacity also need to be in place to ensure the reasonable security and predictability of his investment. The public sector shall require the same enabling environment to ensure that private sector involvement is being obtained at the lowest cost and therefore to the greatest benefit of the public sector.

Moreover, improvement of the enablers is collective; development of one enabler inevitably involves that of another.

There is no absolute measure for progression of PPP enablers and the achievement of an enabling environment for PPP. Moreover, enabling environments may be limited in scope for PPP options with low-level private sector participation (eg PBMC) but much more developed for high-level private sector participation (eg BOT concessions).

An enabling environment for PPP is essential given the nature of the PPP policy objectives and PPP characteristics.

In pursuing PPP, the public sector is principally motivated by securing increased funding for highway investment, introducing private sector efficiencies and, to a lesser or greater extent, encouraging or accompanying a process of public sector reform.

However, PPP projects are by their very nature complex financial, legal and contractual relationships between the public and private sectors and represent long-term political, financial and contractual commitments.

Such complex projects and significant commitments and obligations of the public sector cannot be entered into effectively without a number of factors being in place. The implementation of PPP thus requires:

- Public Sector Commitment: Essential for a stable public role within PPP and the provision of multi-annual public funding and fiscal support.

Public sector commitment is best reflected in an appropriate PPP policy framework. Refer Module 3 - Policy Framework. Sustained political support and commitment is essential, particularly for large projects and projects representing a first attempt at developing and implementing PPP. This is required to generate and maintain sufficient private interest and to allay any concerns over potential public reaction, notably related to the use of user charges and associated promises of increased service provision or quality standards as justifications for their use.

Public sector commitment is the translation of political will into the political and cultural "mainstream" of the government and public authorities in order to ensure the required government support for PPP in its many diverse areas such as those listed below: - support in obtaining land and right-of-way grants, development rights on publicly-owned land, environmental approvals and other permits

- assurances that alternative routes will not be built or substantially rehabilitated

- government capital grants or loans

- fiscal support or incentives, sovereign loan guarantees etc

- support, including political if necessary, of reasonable toll levels and increases

- payment of operating subsidies, shadow tolls etc

- public construction of complementary facilities

- transfer of existing revenue-generating assets

- Favorable investor climate: Encourages private funding under optimal conditions for the public sector.

A favorable investor climate is one which is conducive to private sector funding. Private investment requires a set of established rules and processes to allow reasonable confidence as to the protection of its investment.

A well-defined legal and regulatory framework, allied with a PPP policy, allows contracts to be determined with certainty and allows the parties to understand the boundaries of their interaction. The consequences of not having this certainty have been demonstrated to result in greater risk and cost and the inability to harness the true potential of the project.

Concessions can be granted within economic and financial contexts: All projects must be economically viable. Financially, either projects are financially viable according to the usual financial terms or government support is needed. Government support may be provided through a number of government instruments including by complete or partial payment for the service, where users cannot pay directly (eg viability gap funding).

It is important to review the national and sector laws and legislation in relation to PPPs and examine the possible obstacles and eliminate them (refer Module 4 -> Legislation -> Framework Assessment).

- Effective risk management: Ensures maximum benefits from PPP by risk limitation, mitigation and allocation to the most suited partner.

It is well-known that private investment does not like uncertainty; risk management thus lies at the heart of effective PPP design. Where uncertainty is present, it is priced into PPP projects by the private sector in the form of higher expected rates of return. For certain forms of uncertainty, notably political, legal and regulatory, it may even prevent private finance altogether or result in an unsuccessful partnership. PPP projects thus require by definition the management of uncertainty in the form of risk.

Risk management involves risk identification, assessment, allocation and mitigation. The public sector will assess these within the feasibility study and then needs to ensure an effective strategy to mitigate the risks it is allocated. For example, the political risks of a tolling strategy may be partially mitigated or reduced by an effective public consultation strategy (refer Module 2-> Risk)

Risk should be borne by the party best able to manage it most cost effectively. Additional costs are incurred when too much risk is transferred. A number of generalities can be identified for risk management under PPP: - The greater the financial size of the project, the greater the temptation for risk transfer to the private sector. However, this must be supported by sound revenue earning potential allowing the private sector to adopt a higher risk profile.

- Certain risks are better borne by certain parties. For example, regulatory risk is more appropriate to the public sector while construction risk and quality standard risks are more suited to the private sector.

- Successful risk transfer requires the thorough understanding of the public authority of the objectives it wishes to achieve and therefore the nature of the project. This includes understanding the strengths and limitations of each party. Suboptimal risk transfer results in increases in cost and loss of value for money.

- Capable public and private sectors: Provides for public and private champions of PPP, an effective partnership and the protection of public interest.

The private and public sectors have to understand and respond to their roles within the partnership for PPP to succeed. However, the lack of PPP experience in many countries results in a lack of domestic skills in PPP which may constrain the introduction of the required new methods and practices. Use of advisors may thus be sought to reinforce public and private sector capacities (refer Module 5 -> Advisors and Organization -> Organization)

Reinforcement of public sector capacity may include the establishment of a PPP unit which allows the development of PPP methods and practices and provides information, advisory services to, and sometimes control over, public contracting authorities and private operators, and generally over the wider infrastructure sector including energy, water, telecoms and transport. The PPP unit brings together a range of skills and advises all concerned bodies including the contracting authority on contract preparation and implementation (refer Module 3 -> PPP Policy Framework -> Institutional Framework and Reform -> PPP Units and the role of the Highways Agency).

Moreover, public authorities awarding PPP need to have full confidence in their private partner, since the latter shall assume considerable risks in terms of services of general economic interest. The PPP policy framework referred to above shall need to consider the need for international partners to support the private sector within the PPP consortium, which will likely require market sounding (refer Module 5 -> Dialogue Process).

PPP can only work if it is fairly balanced: the concessionaire cannot operate at a loss nor manage over the long-term a service that shows a structural deficit. The public authority has to ensure the service operates correctly and that it conforms to the terms of contract. Financiers require a balanced contract and that the concessionaire's income assures the reimbursement of loaned capital. The original contract should create this balance and create the conditions for a "dynamic tension" throughout its duration. Subsequently, there should be opportunity for contract revision to enable the contract to evolve satisfactorily over time to inevitable changes but care is needed with renegotiation (Refer Module 5 -> Amendments to Contracts and Dispute Resolution).

![]() Resource Book on PPP Studies, European Commission, 2004

Resource Book on PPP Studies, European Commission, 2004

![]() Guidelines for Successful PPP, European Commission, 2003 (pg 34-35)

Guidelines for Successful PPP, European Commission, 2003 (pg 34-35)

![]() Tollways, the Learning Issue, Five Success Factors for PPP, International Bridge, Tunnel and Turnpike Association (pg 72-75)

Tollways, the Learning Issue, Five Success Factors for PPP, International Bridge, Tunnel and Turnpike Association (pg 72-75)

http://www.ibtta.org/Tollways/issue.cfm?ItemNumber=1176