| Overview & Diagnosis > Overview of PPP experience |

Data bases

Data bases

PPI Data Base

Introduction

The World Bank/PPIAF PPI data base provides rich and detailed information concerning the development of private sector participation in infrastructure financing in developing countries (low or middle-income countries).

The Private Participation in Infrastructure (PPI) project data base tracks investments (physical assets and payments to government) in infrastructure projects with at least 25% private participation which achieved financial closure in 1984 to 2006 in energy (electricity and natural gas transmission and distribution), telecommunications, transport, and water. In the case of highways, the database covers only O&M and BOT-type concessions, including mainly privately-managed toll roads. Management and maintenance contracts, such as Performance Based Contracts, which do not include operational risk by the private party, are not included in the database.

Projects are defined in the database as management or lease contracts, concessions, greenfield projects, and divestitures, as defined below.

- Operation and management contract. A private entity takes over the management of a state-owned enterprise for a given period. This category includes management contracts and leases.

- Operation and management contract with major capital expenditure. A private entity takes over the management of a state-owned enterprise for a given period during which it also assumes significant investment risk. This category includes concession-type contracts such as build-transfer-operate, build-lease-operate, and build-rehabilitate-operate-transfer contracts as applied to existing facilities.

- Greenfield project. A private entity or a public-private joint venture builds and operates a new facility. This category includes build-own-transfer and build-own-operate contracts as well as merchant power plants.

- Divestiture. A private consortium buys an equity stake in a state-owned enterprise. The private stake may or may not imply private management of the company.

The PPI database does present an optimistic picture, because it represents commitments entered into by the project entity at the beginning of the project (at contract signature or financial closure), not the planned or executed annual investments, it covers total project investments including possible shares attributable to the public party and maintains information on cancelled projects until such projects are re-awarded. However, it excludes follow on and locally financed activities, some of which are funded by the private sector.

Moreover, given data characteristics, the database does not provide an exhaustive listing of each and every infrastructure project with private participation in every developing country or a precise estimate of investments. It is very likely that some projects have been missed and investment figures are rough estimates. Rather, the objective is to provide access to detailed and aggregated data that can serve as the basis for estimates and analysis of private participation in infrastructure and its trends by country, region, and sector.

Results

The period since 1990 has seen a large volatility in PPP investments in the highway sector in developing countries, with a peak in 1997 of 58 projects with a total investment of USD 9.7 billion. However, two years later in 1999, investment commitments were at their lowest at USD 2.2 billion. This sharp decline of PPP projects at the end of the 1990s was largely the result of the economic crisis that affected many developing countries, particularly in Asia and which significantly affected foreign investments and highway PPP investments in particular.

The Latin America and Caribbean region was predominant in PPP investment in the 1990s, as a result of extensive toll road programs.

Since the year 2000, private investment has been marked by growth of investment in East Asia and Pacific, notably through continued major investment in the toll road network in China, and, more recently, the emergence of South Asia, as a huge recent increase in PPP investment in national highways in India (in 2006, India was the greatest receiver of private investment with USD 4.0 billion or 40% of the total investment worldwide for the year).

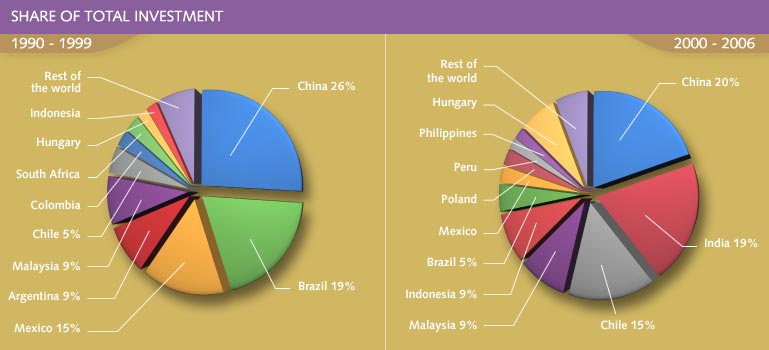

However, this investment in PPP has been predominantly concentrated in only a few countries. Although a total of 32 countries have received private infrastructure investments since 1990, in both periods presented in the figures below 50%of investment was concentrated in only 3 countries and 90% in only 10 countries. As a result, only 10% of total investment in each period was shared between the remaining 11-14 countries. Moreover, a further 117 developing countries did not receive any private investment at all in the highways sector (based on a total of 149 countries classified by the World Bank as low, lower-middle and upper-middle-income countries).

Also, since the year 2000, there has been a marked increase in investments towards low-income and lower-middle-income countries. Whilst in the 1990s, 2/3rds of investment was concentrated in upper-middle-income countries (indeed, outside of China, only 9% of investment was in low or lower-middle-income countries), since the year 2000, India has emerged as the first low-income country to receive major flows of private investment. This has resulted in an increase of share of low-income countries from 2% to 19% of total investment. Although India undoubtedly disposes of more advanced financial and technical capacity to support PPP programs than most low-income countries, the rapid growth in private investment in its highway infrastructure may serve to widen the potential of PPP projects to lower income countries.

The average size of PPP projects shows a tendency for a running average at around USD 150 million per project, with an annual range of USD 100-400 million, resulting from the absence or not of mega-projects in a given year.

Analysis of investment by type illustrates an interesting progression of greenfield projects, referred to in the Toolkit as BOT-type concessions, in the past few years, as opposed to concession projects as per the PPI data base definition, which are brownfield projects, or lease-type concessions, as referred to in the Toolkit.

Worldwide

International Major Projects Survey, PWF

The International Major Projects Survey of Public Works Financing, PWF (USA) was started in 1991 to monitor the development of PPP projects worldwide in the transportation and water sectors. The cumulative database now includes 2,670 projects worth USD 1,146 billion that have been proposed, put under construction, or completed for governments in 123 countries. Of that total, PWF records 1,340 projects worth USD 575 billion as being placed under construction or completed since 1985.

The database presents mainly publicly sanctioned infrastructure improvements, but also includes privately developed rehabilitations, upgrades and expansions of existing facilities. Also represented, but to a lesser extent, are new "greenfield" projects requiring site selection, environmental reviews, land acquisition and other pre-construction activities and sales of government assets to private investors.

![]() Paid access to database on http://www.pwfinance.net/

Paid access to database on http://www.pwfinance.net/

Global project finance market, Infrastructure Journal R&A

Infrastructure Journal R&A, a unit of Infrastructure Journal that conducts independent and in-depth reviews of global project finance market activity, has a global project finance database of more than 2,000 infrastructure projects worldwide comprising:

- Projects that have reached financial close since January 1, 2005 and;

- Projects in the pipeline

Financial close deals are included in the database only if a significant part of the project is funded under a limited recourse or non-recourse project finance structure. The database also contains non-project finance transactions, for example acquisition financing of existing infrastructure assets, to provide users with a sample of these types of transactions that have been under the spotlight in recent years.

Deals in the pipeline are projects in progress and are tracked from the moment they are announced until a bank(s) is mandated by the borrower to arrange project finance.

![]() Paid access to database on http://www.ijonline.com/

Paid access to database on http://www.ijonline.com/

UK Project Database

Partnerships UK (PUK) is an example of a national PPP database. It maintains a project database of projects in the PFI program. Its objective is to provide an extensive and readily available evidence base for all PPP projects within the UK.

The database holds details of 865 projects in all sectors of the PFI program including highways but mainly public buildings, such as hospitals and schools. These projects have all achieved financial close and are primarily PFI schemes.

It is planned to expand the database to include some operational data in areas such as benchmarking and insurance.