| Policy & Planning > Sector Planning and Stategy > Planning and policy making |

Socio-economic Evaluation

Socio-economic Evaluation

General Principles

A general principle is that the public sector will optimize the economic impact of the road network through embarking on economically viable projects which will contribute to the development of the region and country concerned. The impact of the investment on the poor should also be assessed and measures to maximize the positive impact on the poor introduced.

Socio-economic Evaluation

Economic feasibility studies analyze the relation between the costs and benefits of a project. But cost-benefit analysis (CBA) is only one aspect of economic evaluation. The evaluation should ask broader questions to address socio-economic impacts overall.

The socio-economic analysis should assess the rationale for public intervention and whether the intervention is the most appropriate means of addressing that rationale.

On the issue of institutional arrangements, the evaluation should focus heavily on assessing whether the various agents involved have the proper incentives to realize the desired outcomes.

![]() The economic analysis of sector investment programs. Suthiwart and Narueput. The World Bank, 1998.

The economic analysis of sector investment programs. Suthiwart and Narueput. The World Bank, 1998.

The main purpose of project socio-economic evaluation is to help design and select projects that contribute to the welfare of a country. It is most useful when applied early in the project cycle and of very limited use when employed once the project is committed.

Following the prevailing World Bank approach, the socio-economic evaluation is seen in a broader sense than the traditional cost/benefit analysis. Indeed, the handbook lists ten questions which an economic analysis should answer, namely:

- What is the objective of the project?

- What will happen if it is implemented, and what if it is not?

- Is the project the best alternative?

- Are there any separable components, and how good are they separately?

- Who are the winners and losers?

- Is the project financially sustainable?

- What is the project's fiscal impact?

- What is the project's environmental impact?

- Is the project worthwhile?

- Is it a risky project?

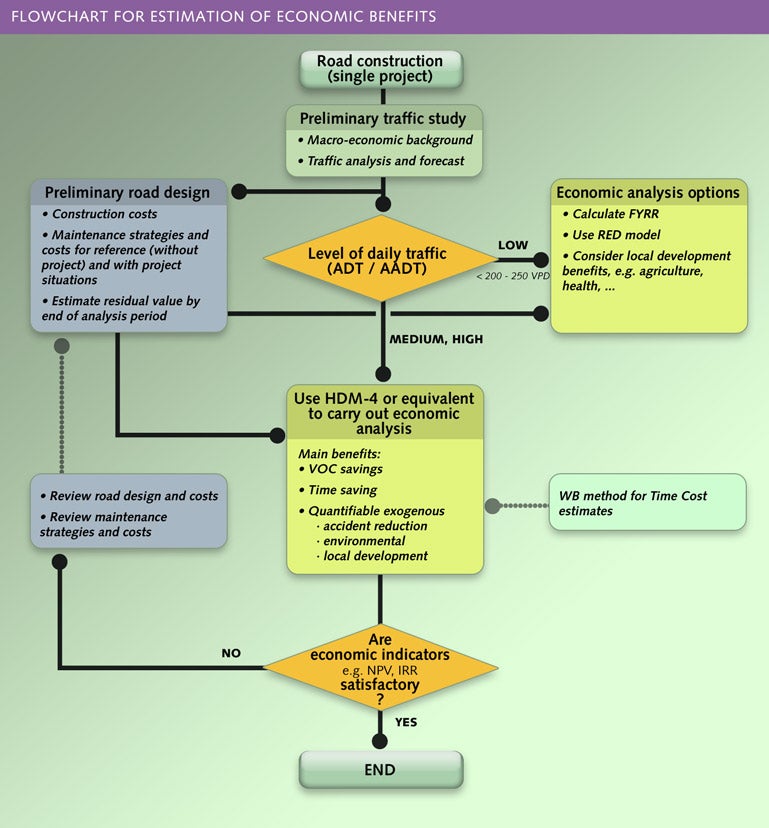

Economic analysis can also indicate optimal project timing through use of the 'First Year Rate of Return' which is shown in the flowchart below.

In addition, it is necessary to analyze whether the project will be better be carried out by the public or by the private sector.

![]() Transport Project Appraisal at the World Bank, Gwilliam, The World Bank, (2000), page 7

Transport Project Appraisal at the World Bank, Gwilliam, The World Bank, (2000), page 7

The nature of economic costs and benefits

Module 5 describes the detailed component of costs and benefits within economic analysis.

For most infrastructure projects, annual operating and maintenance costs will relate to the capital cost of the project. Other costs will include land costs and environmental and social mitigation costs including resettlement costs. Some costs are difficult to quantify and some costs are not quantifiable such as the impact on the landscape.

For most transport projects, the major economic benefits are derived from vehicle operating cost (VOC) savings, computed and valued in compliance with the road user (consumer) surplus theory. Benefits for road users may also include reduced driving time, reduced driving costs, fewer accidents, and environmental improvements.

The comparison of traffic volumes, with and without the project, constitutes the basic principle of the analysis. However, in the case of low-traffic roads it may be necessary to consider additional benefits related, for instance, to development of agriculture, improved access to water supply, health or education (see also below "specific issues concerning rural roads").

How to estimate tangible and intangible benefits?

| Note on HDM software: The Highway Design and Maintenance Standards Model (HDM-III), developed by the World Bank, has been used for over two decades to combine technical and economic appraisals of road projects, prepare road investment programs and analyze road network strategies. The International Highway Development and Management Study was carried out to extend the scope of the HDM-III model and provide a harmonized systems approach to road management, with adaptable and user-friendly software tools. This resulted in the Highway Development and Management System (HDM-4) tool. |

Where such aggregate standards are not available, VOCs may be computed on the basis of monetary and physical inputs using dedicated models such as HDM (Highway Development and Management System). The latest version HDM-4 simulates and calculates the cost of accidents based on specific inputs by the users on the value of life or the cost of an accident.

| Estimation of Unit Working and Non-Working Passenger Time Values | |||

| Parameter | Value / % | Sources and Calculation | |

| a | Gross Domestic Product | Source: | |

| b | Population (million) | Source: | |

| c | GDP / Capita - (value), in year ... | =(a/b) | |

| d | Employment ratio (%) | ||

| e | Total No. employed (million) | =b*d | |

| f | GDP / Employed person (value / year) | =a/e | |

| g | Household Consumption Expenditure (% GDP) | IMF | |

| h | Income - employed person (value / year) | =f*g | |

| i | Other costs of employment @ 33% (Gwilliam) | =h*i | |

| j | Total income and employment costs | =h+i | |

| k | Working hours per year | ||

| l | Average Working Time Travel Cost (value / hour) | =j/k | |

| m | Value of Non-Working % of Working Time (%) | ||

| n | Average Non-Working Time Travel (value / hour) | =l*m | |

Sources: Based on K.M.Gwilliam - "The Valuation of Time in the Economic Evaluation of Transports Projects - Lessons from Recent Research" - World Bank Infrastructure Note: January 1997.

Commercialization and Contacts:

In the past HDM-4 products were produced by the International Study of Highway Development and Management Tools (ISOHDM), sponsored by The World Bank, the Asian Development Bank, the Department for International Development (UK), the Swedish National Highway Authority, and other sponsors. However, starting with the latest HDM-4 Version 2, the software is commercialized by an international consortium of academic and consultancy companies that formed a partnership under the brand name "HDM Global". At the center of the consortium is the Highway Management Research Group, a UK based association.

The HDM-4 software can be ordered from HDMGlobal who have been granted exclusive distribution rights from PIARC for a period of five years.

Details on the software are available at the following internet site:

There are also three main "intangibles" for which market valuations are not always directly available and which are therefore the subject of debate as to their quantification.

These are:

- Time savings

- Accident savings

- Environmental Impact

In developing countries, there has been a tendency in the past to treat transport project savings related to operating costs as more "real" than savings in travel time. Rates of return have therefore sometimes been estimated initially excluding time values, and enhanced rates including time valuation given as an extra. To justify a project without recourse to time savings was viewed as a test of robustness. This attitude is changing and time savings are often accepted as a legitimate element of benefit. As a compromise, sometimes only working time savings are only fully valued by relating to wage rates with non working time valued much less.

In developed economies, time savings are usually the main economic benefic of a new infrastructure. In some countries standard values of time shall be used in evaluation. Using standard values of time savings in a country promotes equity among different regions and different socio-economic categories.

The valuation of accident savings has been even more controversial, and in particular the question of valuing of pain and grief, including the loss of life. Increasingly, there is a requirement that safety audits be performed on project designs. This may have the effect of incorporating the costs of accident prevention measures within the overall project costs, without considering the counterpart benefits resulting from these safety improvements as project benefits, hence understating the true rate of return.

According to World Bank practice (other international donors have a similar approach), all projects are pre-classified according to whether they have zero, small or large environmental impacts. Those with non-zero impacts are required to have environmental impact assessments (EIA), and to contain mitigation measures to counter any adverse effects. This mandatory requirement covers the more obvious, immediate, consequences of projects. It does not, however, deal with more subtle effects, either positive or negative, associated with traffic generation or modal shift effects. However there is no objection in principle to the inclusion of such environmental effects in the economic evaluation, and it is increasingly done, and always in cases which are primarily viewed as environmental projects. This partly reflects the absence of adequate data on the physical impacts of specific interventions, as well as the absence of evaluation conventions.

For low traffic roads, user cost and time savings may be small and therefore accident and environmental benefits can be significant and again are increasingly included in the economic evaluation of highway investment.

Specific issues concerning toll roads

It should be noted that in addition to the economic considerations discussed above, policymakers must consider numerous non-economic issues when evaluating toll road programs. These include public acceptance of tolling, the equity of charging tolls for road use, and the impact on the government's flexibility in future road development (see previous Section entitled Demand Forecasting).

![]() Private Financing of Toll Roads, Fishbein and Babbar, RMC discussion papers series 117, page 21.

Private Financing of Toll Roads, Fishbein and Babbar, RMC discussion papers series 117, page 21.

![]() IRF Bulletin; Special Edition on PPPs, April 2008.

IRF Bulletin; Special Edition on PPPs, April 2008.

Specific issues concerning rural roads

Low volume rural roads, and particularly feeder paths and tracks, have created some particular problems. Firstly, where initial/ base year traffic volumes are very low there are usually difficulties to estimate the average daily traffic. Secondly, there are problems of evaluating the benefits to non-motorized transport (NMT) which may constitute an important component of the traffic. Thirdly, the impacts of transport improvements on basic access to services (school, clinic, etc.) are not easy to assess. Fourthly, the cost of detailed appraisals of individual small projects is relatively important in proportion to the cost of the infrastructure (i.e. it makes better sense to appraise projects whose appraisal costs are lower in proposition to the investment cost).

However, for low traffic roads, quantifiable estimates may be made for accident reduction and environmental improvements.

A report from the International Road Assessment Programme (iRAP) describes the work done to invest in practical new road safety tools for low- and middle-income countries and then pilot their application in four countries around the globe.

The World Bank approach to feeder roads

International practice regarding local participation in the feeder road area, while motivated by the perceived benefits of local ownership and decision-making, has focused primarily on developing applicable tools for local communities and local governments to plan and undertake their own (simplified) analysis and planning process. Most of these analytical tools are typically based on one of the following approaches:

- the application of simplified or modified versions of economic decision analysis,

- a locally adapted (calibrated) version of multi-criteria analysis - usually based on a combination of observed/ quantifiable parameters (e.g. traffic, trip purpose, economic activity) and selected social weights (typically related to population within the project's "area of influence"), or simply by undertaking an implicit weighting of investment benefits,

- a form of cost-effectiveness analysis - as in the basic access approach which used USD per population to serve as a indicator of the relative value of competing investments.

The motivation for the development of these planning tools is to introduce some form of rational decision making into a local planning process (at least, related to principles of economic analysis and the desire for social/human resource development).

Cost-benefit analysis (CBA), net present value (NPV), internal rate of return (IRR), discount rate

Over the last 20 or 30 years, various methods have been used to formulate the relation between costs and benefits, including classical benefit/cost (B/C) ratios, incremental cost/benefit ratios, net present value (NPV) and first year rate of return. Current practice among international financial institutions and funding organization, when making decisions on loans, is to analyze costs and benefits in terms of the economic internal rate of return (EIRR) (also see following section entitled Economic versus financial analysis).

The internal rate of return is the calculated discount rate at which discounted costs equal discounted benefits, i.e. at that discount rate the net present value of the annual cost streams equals zero. The time value of the investment should reflect the Opportunity Cost of Capital (OCC), i.e. the value of alternative investment opportunities over time. For example, money invested in the construction of roads could be invested elsewhere and earn a dividend. Normally, the discount rate used is the government accounting rate of interest (ARI), which is the rate at which the value of uncommitted government income in constant price terms falls over time. The ARI is the OCC in the public sector, i.e. the rate of return on marginal public sector investment.

However, there is no standard criterion for defining the level of the EIRR to make any given road project viable. The social discount rate is one indicator, but as yet no one has come up with a concrete formula for obtaining the social discount rate. In practice, the minimum viable level of EIRR will depend on the circumstances of each country, each at a certain point in time.

The following figure illustrates a case where the IRR is approximately 14%.

Generally in developing countries projects with an estimated EIRR in excess of 12% tend to carry a high priority for implementation.

It is recommended to use the NPV economic indicator to choose a scheme among mutually exclusive alternatives, e.g. various possible alignments of a road between similar origin and end points. The EIRR should be used to rank a series of independent projects in order of importance (the higher the EIRR the more important the project).

![]() Global Toll Road Study, Knowledge Data Base level 2 (draft), MOCJ - EXTEC (2000), page 22.

Global Toll Road Study, Knowledge Data Base level 2 (draft), MOCJ - EXTEC (2000), page 22.

The original CBA of the road could compare alternatives based on the different financing, construction and operating options. Further, the alternative of a privately financed, built and operated toll road could be compared with (i) a road financed with public funds but built and operated by the private sector through competitively tendered contracts or (ii) a road that is financed, built and operated entirely by the public sector. In practice, however, such comparisons are very rarely undertaken: the difference between public and private relies largely on assumptions about the relative efficiency of either sector during each stage of the road development and operation phases, and those assumptions are difficult to model.

Economic versus financial analysis

Often the differences between economic and financial analysis are not thoroughly understood.

The purpose of economic evaluation is to provide a view on the feasibility of investment from the national, resource viewpoint. It differs from financial analysis which provides information on the direct financial implications of investment including profitability.

Economic evaluation, therefore, considers only resource costs and excludes transfers such as taxes and subsidies. It also takes into account the price of local (non-traded) inputs which may be overpriced or underpriced relative to market conditions. Minimum wages may overprice labor relative to its market value and subsidies, say for fuel or water, may underprice inputs.

Shadow pricing i.e. adjusting for market imperfections and transfers is the mechanism by which these market defects are overcome, and all economic costs and benefits brought to the same yardstick.

Therefore the general equation is:

Economic price (cost) = (market price – taxes + subsidies) * Opportunity cost of local inputs

This means that after subtracting monetary transfers, the local factor inputs such as labor, materials, transport etc. are valued at their opportunity (or market) cost. Imports are usually priced at market levels.

A further important difference is that in an economic evaluation the situation "with project" is compared with the one "without project" i.e. we are only concerned with the difference. By contrast, in a financial analysis, only the return on investment of the 'with' project is considered.

The financial analysis consists in comparing revenue and expenses (investment, maintenance and operation costs) recorded by the concerned economic agents in each project alternative (if applicable) and in working out the corresponding financial return ratios.

Unlike the economic analysis, the financial analysis is only concerned with the direct financial costs and revenues of a scheme or project and also only the impacts on the specific organizations concerned not to the country.

Usually tolls are not directly included in the economic evaluation to compute total benefits (except in the case of generated traffic) they nevertheless constitute a key factor of the economic analysis, as the level of tolls are likely to affect the transport demand and hence the economic worth of the project (in particular the economic rate of return).

There is in fact a double trade-off when trying to set-up a toll rate:

- the economic optimum scheme does not necessarily correspond to the financially preferable solution (also see previous section Influence of tolling on transport demand) and it must be remembered that without congestion the economic optimum toll rate is nil (i.e. users do not have an incentive to divert from the existing facility to a toll road and incur a toll if the existing road offers a similar level of service).

- the toll level that would balance economic and financial constraints may not correspond to the willingness-to-pay of the road users.

Finally, it must be remembered that economic and financial analysis are not self-contained topics: they are used to verify the economic and financial sustainability of the projects likely to be implemented.

The financial sustainability of a given project may not be compatible with the economic sustainability, and the value of key parameters such as tolls must be adjusted in order to cope with both economic and financial constraints (see also willingness-to-pay).

Usually an economic analysis is carried out first and only if the results are encouraging i.e. the project is economically justified, will a subsequent financial analysis for PPP be envisaged.

It should be noted that the economic rate of return can be much higher than the financial return because;

Benefits of reduced congestion on existing non-tolled roads are included in an economic analysis but are not included in the financial benefits

The toll road usually only captures, in financial terms, a part of the economic benefits enjoyed by toll road users.

Aspects of the difference between economic and financial viability are discussed in the Case study on the Indonesian Toll Road program.