| Overview & Diagnosis > PPP strategy | Enabling Framework | Toll Revenues and Tariffs |

Adapting PPP to the country context

Adapting PPP to the country context

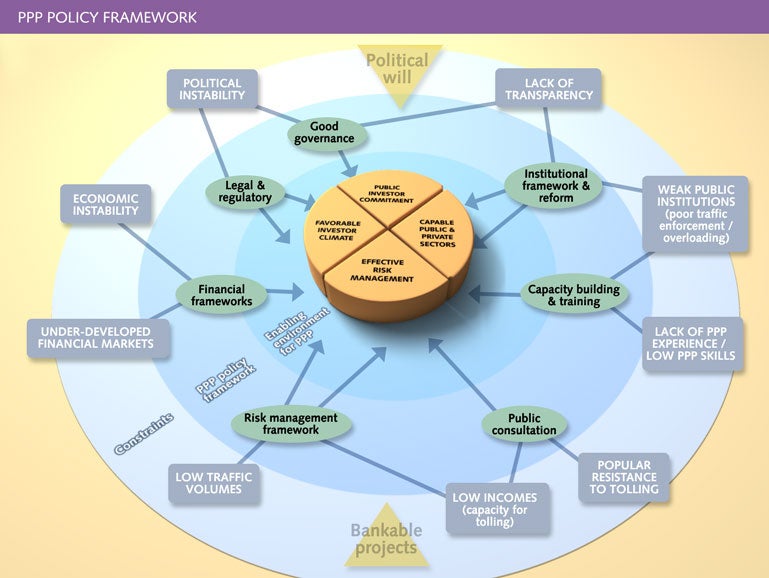

The development of a successful PPP program requires two key drivers: political will and bankable projects. The subsequent implementation of such projects necessitates that an enabling environment for PPP be established for finance to be mobilized and the partnership to work effectively and to the benefit of both parties.

The route to an enabling environment passes through the PPP policy framework which comprises a number of interlocking structures including legal and regulatory, risk management, institutional, financial, private sector and other aspects.

However, this framework is established in the context of a number of constraints, the nature and extent of which shall depend on the particular economic, social and political conditions prevalent in the country. These constraints may hinder, delay or even prevent the establishment of the required components of the PPP policy framework.

The environment for establishment of the PPP policy framework is represented on the figure hereafter.

As shown in the figure, achieving an enabling environment, shown in the center, passes by the development of the PPP policy framework. This framework is developed within the country context, represented by the various constraints which may be present within the highway sector and the wider political, legal, institutional, social and economic environment, constraints which shall determine the nature and pace of structural change of each the components of the PPP policy framework. The key drivers are essential to ensure that the process may move forward and that sufficient momentum is maintained.

Drivers of PPP

The key drivers are essential to ensure the initiation, pursuit and ultimate success of the PPP program.

|

PPP Drivers |

Why? |

How? |

|

Political Will |

Essential pre-condition for development of PPP which drives the public sector response and long-term commitment to PPP |

Strong political commitment by manifesto or statement Securing of public champions |

|

Bankable Projects |

Projects which can most readily secure private finance |

Best projects are those of sufficient size to attract private sector, not too complex or risky and which need little government support |

The drivers of PPP may be described as:

- Political will to introduce PPP: a sovereign commitment producing clear stable perspectives

A state considering the launch of a PPP policy for the provision of infrastructure facilities and/or public services must announce firmly its intention to do so in an unequivocal manner.

No private sector partner should have to re-negotiate a contract with successive governments and the government should demonstrate strong commitment to pursue policy objectives within an evolving political environment.

Private sector partners need to understand the involvement of the public authorities knowing what framework has been set up: strategy, means, management process and principles are all important elements in the private investor's evaluation.

Refer Module 5 -> Advisors and Organization -> Organization - Bankable projects suitable for funding by the private sector

The fundamental for the identification of PPP procurement options is to have projects with sound economic and financial credentials. The public authorities need to ensure thorough project preparation and the identification of suitable procurement routes under PPP. Moreover, given the complex interactions between service provision and financial viability, the private sector should also perform rigorous project analysis and estimate the project parameters independently. Many highway projects have failed due to poor demand or cost forecasting.

Initially, the best projects should be selected which are of sufficient size to attract the private sector, not too complex or risky and which need little government support. This reduces the exposure of the project to inconsistent public commitment and inadequate fiscal space/financial support.

PPP policy framework

Experience with PPP worldwide, suggests that it is useful, if not essential, to have a PPP policy framework in place, to facilitate planning and implementation and instill confidence and understanding in all participants in the PPP process. This includes both public and private partners.

PPPs have developed amid incomplete reforms and only partly developed frameworks, and generally all countries have embarked on the PPP process in that way. However, the key message is that to accelerate an effective PPP development program, governments should work towards and develop an effective facilitation/enabling framework as soon as practicable.

This framework provides a set of rules that gives confidence to both the public sector which has to implement the rules and also the private sector which has to invest time and money and aims to ensure that both will achieve, within acceptable bounds, their objectives.

It seems clear that at the outset of PPP development on any scale, analysts and reformers were often, but not always, overly optimistic that governments could within a short space of time, by public sector scale, implement reform, create institutions, design concessions and establish a regulatory framework that would be complete and successfully functioning.

Furthermore, some of the proposed models for low-income and even middle-income countries came from the experience of OECD countries, some of which had different types of difficulties in pursuing their application.

A PPP policy framework is an evolving tool; it should not be viewed as an ideal or even something to be aimed at in total at once. Required changes will take time to agree and implement and will only be felt in the medium- to long-term. It should thus be developed with a long-term process in mind which would allow its progressive adaptation and improvement in line with the experience from implementation of the PPP program.

Constraints

Constraints to PPP policy are reflective of the specific environment of the country. They are a result of the individual and particular conditions prevalent and resulting from the development of the country in its particular environment and context.

Constraints may hinder, delay or, indeed, prevent the development of a PPP policy. Indeed, the majority of developing countries which have not yet developed PPP strategies likely have constraints to their implementation which are considered to outweigh the potential benefits, at least in the short- to medium-term. Constraints increase the political stakes in implementing PPP programs and the resulting political boldness and determination to see them implemented.

The figure "PPP Policy Framework" indicates several constraints which are often prevalent in low- and middle-income countries and which have a determining impact on the development and success of PPP programs.

- Political Instability

- Economic Instability

- Under-developed financial markets

- Low traffic volumes

- Low incomes (capacity for tolling)

- Popular resistance to tolling

- Lack of PPP experience/low PPP skills

- Weak public institutions (low traffic enforcement/overloading)

- Lack of transparency

Constraints can also be imposed by the international context. Countries participating (or planning to participate) in international communities (e.g. free trade agreements, economic communities) have to develop national policies in line and coherence with the common strategies and regulations.

| Economic convergence criteria of the European Union One of the most well-known constraints in economic communities are the agreed limits on public sector debt and deficits agreed by the EC countries in the Treaty of Maastricht as preconditions for membership in a monetary union. These fiscal convergence criteria require that general government budget deficits should not exceed 3% of GDP and that the gross debt of the general government should not be above 60% of GDP. Such criteria can favor develop of PPP programs, insofar as related investments are considered off-budget for public accounting (Module 2 -> Public Accounting) |

This combination of constraints generally works against effective PPP projects in developing countries. The combined effect of low traffic volumes and low capacity to pay within weak institutional and economic environments means that private concession models based on user tolls are likely for some time to be less widespread in developing countries than in industrialized countries.

Some of the constraints are discussed hereafter. Other constraints are at a macro level and are not addressed by the Toolkit.

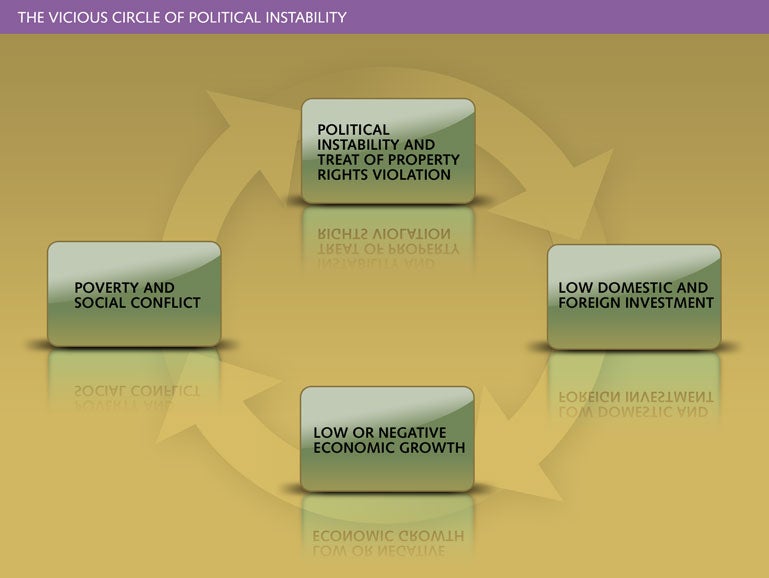

Political instability

Developing countries are the most prone to conflict and instability. However, political stability is one of the most important factors which makes investing in one country more profitable and less risky than in another country. Both domestic and foreign investors are discouraged by the threat of political upheaval and by the prospect of a new regime that might impose punitive taxes or expropriate capital assets. As a result a country can fall into another vicious circle, one seen historically in many African and some Latin American countries (see figure below). Political instability scares away new investments, which prevents faster economic growth and improvements in people's economic welfare, causing even more dissatisfaction with the political regime and increasing political instability. Falling into this vicious circle of political instability can seriously impede efforts to boost economic development and reduce poverty.

Source: Beyond Economic Growth, VI Poverty and Hunger, World Bank, 2004

Under-developed financial markets

Financial/funding constraints may be addressed by use of IFIs for risk mitigation, facilitation of regulatory dialogue and provision of technical assistance. Funding may still be available but on less favorable terms than with a developed capital market.

By covering critical sovereign risks that the market is unable to absorb or mitigate, guarantees from IFIs can attract new sources of longer term commercial financing at reduced financing costs and extended maturities. For example, each dollar of guarantee financing provided by the World Bank has leveraged close to 5 dollars of private finance.

Popular resistance to tolling

Popular resistance to tolling would, if not addressed, prevent use of user revenues and continue reliance on public sector budgets to finance PPP through availability or shadow toll arrangements. The scope of PPP to provide new financing would thus be limited to efficiency gains and the advantages of off-budget financing (Module 2 -> Public Accounting).

Popular resistance results from both the unwillingness to pay for a previously-free infrastructure, possibly reinforced by a culture or tradition of freedom of movement. The legacy of free infrastructure under public funding often makes it difficult to jump immediately to private funding based on user charges. Indeed, most attempts to finance the building of East European transport infrastructure by means of toll revenues were abandoned or put on hold, with the notable exceptions of the M5 motorway in Hungary and the A4 (Katowice-Krakow) highway in Poland.

The low incomes in developing countries substantially reduce the surplus between acceptable and actual toll levels and may exclude several social groups from using the road infrastructure unless associated social measures are adopted (Module 3 -> Sector Planning and Strategy -> Planning Process -> Demand Forecasting).

Historically, tolls have been favored in Southern European nations such as France, Italy, Portugal, and Spain – together with many developing nations – whilst the United States, Northern Europe and Japan has favored the tax-based approach using general tax revenues, earmarked fuel taxes or other dedicated taxes to pay for projects.

In the UK, the PFI program is founded on the use of availability and shadow toll arrangements, representing the tax-based approach; tolling being limited to main bridge and tunnel sites in England and Wales, with the exception of the M6 road toll (Module 6 -> Case Studies -> United Kingdom). In Scotland, bridge tolls were indeed scrapped in 2008 as a largely popular move following the election to government of the Scottish National Party.

| Scotland, UK: End of road bridge tolls (February 2008). Exchange rate £1 = USD 2. Tolls on the Forth and Tay road bridges were scrapped on 11 February 2008. The Forth Estuary Transport Authority and Tay Road Bridge Joint Board remain responsible for managing the bridges. They will receive funding directly from the Scottish Government. The Tay board will also receive a one-off grant of £14.8m to allow it to repay all outstanding loans. The transport minister said: "We said when we came into power that we would bring an end to tolls on Forth and Tay bridges, and less than nine months into government, that is exactly what we have done. Today marks the end of years of injustice for the people of Fife, Tayside and the Lothians, and I am delighted that in just a few days' time travelers across the bridges will no longer have to pay tolls. There will now be equality on all bridges in Scotland and I am sure this announcement will be welcomed by people across the country". The legislation scrapping tolls on the two bridges - £1 for cars on the Forth bridge and 80p on the Tay - was backed by the Scottish Parliament on 10 December. The bridge's new toll booths were opened in 2006 at a cost of £4m in a bid to manage traffic flow and make toll collection easier. Tolls were abolished on the Skye Bridge in December 2004 and on the Erskine Bridge in May 2006. |

An effective approach to popular resistance to tolling generally requires a tolling strategy and effective communication. The adoption of a tolling strategy can generate public acceptance for tolls and facilitate the implementation of a PPP program based on user fees.

Tolling has to be (and more importantly be perceived to be) constructive (not penalizing road use) and adjusted to the specific road network of each country to ensure utmost transport effectiveness. In such cases, tolling is the ultimate user pay system – the user pays a price that he is willing and able to afford in return for a clearly defined service provided by the road agency. "Value for money" drives this arrangement and makes it publicly acceptable. In developing countries, the purchasing power of the population at lower socio-economic levels also has to be taken into consideration.

Prices (tolls) should attempt to cover all costs, including operation, maintenance and investment. When tolls do not cover all costs, government should consider forms of government support, including an up-front payment, shadow tolls or an availability payment.

In Ghana, the presence of a tolling strategy, albeit modest, could increase public acceptance and improve the possibility of toll-based user revenues for PPP. In India, as part of its significant PPP highway investment program, the government, largely for political reasons, has defined a uniform user fee –toll rate –for all PPP projects around the country.

| Road tolls in Ghana Tolls are levied on some major roads and bridges operated by the Ghana Highway Authority and collected as revenue for the Road Fund. The authority was responsible for all toll collection but in 2002 collection on roads and bridges was franchised to the private sector. GHA only collects tolls where the private toll collector has defaulted. The annual amount raised (2004) is modest at USD 1.75 million or 2% of revenues to the Road Fund (93% of funding is from fuel levy, the remainder from vehicle and transit fees). This is largely since the toll rate toll has remained unchanged in local Cedi since 1998 and despite traffic growth, toll revenues have remained stagnant in USD terms. |

Governance and Corruption

Public disclosure of concession agreements is highly desirable. In recent years, a growing number of countries have taken the step of publishing concession agreements they have made. This has several benefits:

- it provides a further check on corruption, which in addition to its direct benefits can enhance the legitimacy of private sector involvement in often sensitive sectors; and

- when the concession agreement relates to the provision of services to the public, it provides consumers with a clearer sense of their rights and obligations, and can facilitate public monitoring of concession performance.

The lack of transparency in concession agreements may lead to serious public concerns, as highlighted in a recent report by Transparency International (2005).

Addressing the constraints

Setting up a PPP policy requires redefining the role of Government in the transport sector. The changing focus in transport policy reduces the Government's functions as supplier, but increases its functions as regulator - the enabler of competition.

This means that governments need to create the proper institutional framework for competition, set economically efficient charges for the use of publicly provided infrastructure, carefully appraise the allocation of scarce public resources and increase community participation in decision making.

Constraints limiting private sector involvement can only be removed through long-term and in-depth reforms. As an example, a contractual package comprising a long-term rehabilitation and maintenance program on a large part of the road network would not work in countries with only a few private civil works companies characterized by low skill levels and limited financial liability. Long-term reform aiming at developing and structuring the construction industry would be priorly required.

In short, in the development of PPP projects, five types of constraints must often be overcome:

- Political constraints, which must be tackled with the aim of developing and establishing clear and sustainable rules and agreements between the relevant public authorities, between these authorities and the affected users, and between the authorities and the private sector

- Legal and Regulatory constraints, that must be overcome to provide transparent procedures to delineate market competition and tariff-setting in relation to project construction and operation, ensure contract enforcement and secure private ownership.

- Economic and Financial constraints, which stem from economic development, public budgetary limits and hesitant user charge policies. They must be addressed to achieve a sound financial structure for all project phases;

- Social and cultural constraints, which determine the level of acceptance of road user charges, of private investment in public infrastructure and services and of possible foreign-led investment.

- Public sector constraints, which stem from frequently limited knowledge of inter-related variables and which prevent a clear definition of performance indicators or the estimation of key values which are crucial for project economic and risk evaluation.

- Private sector constraints, hindering responsiveness to the needs of the transport sector and to bring efficiency gains.

The first two constraints often result from a tendency for excessive control of private management through over-regulation; the financial constraints originate in the fact that transport investments are often large and their cost can only be recovered over long periods of time. The fourth constraint stems from the fact that the people involved at the project preparation stage usually only have limited knowledge of the subject. The fifth constraint is often due to the lack of dynamism of the construction industry unused to long-term commitment and risk taking.

Reforms are made to reduce these constraints and open the ground for innovative PPP. The table below shows some of the most needed actions that could be taken in this regard, both at policy and project level.

| Most needed actions to address constraints to PPP | |||

|

Types of constraints |

Particular constraints |

Type of reform needed |

Specific actions |

|

Political constraints |

Political instability Lack of transparency Weak public institutions (poor traffic enforcement / overloading) |

Good governance principles |

Ensure and demonstrate commitment to PPP policy and projects. |

|

Legal and Regulatory constraints |

Weak public institutions (poor traffic enforcement / overloading) |

Adjust the legal framework to facilitate PPP (dispute resolution, private ownership, concession laws,...) Set up regulatory body Clarify procurement procedures |

Train agency staff in contract management and regulation |

|

Economic and financial constraints |

Economic instability Under-developed financial markets Low traffic volumes Low incomes (capacity for tolling) |

Economic development Secure revenues for road sector from road fund, road user charges (dedicated taxes, tolls) Develop financial markets (reform banking system, set up infrastructure investment funds) Develop methodologies for public risk assessment |

Use IFIs for risk mitigation, facilitation of regulatory dialogue and provision of technical assistance Stable economic management Support development of domestic financial markets and integration into regional initiatives |

|

Social and cultural constraints |

Popular resistance to tolling |

Coherent tolling strategy at national level |

Assess sensitivity of the public on road user charges Introduce tolling on improved and targeted sites on highway network (bridges, ferries) to increase public acceptance Viability gap funding to subsidize/support poorest users. |

|

Public sector constraints |

Lack of PPP experience / low PPP skills Weak public institutions (poor traffic enforcement / overloading) |

Creation of a business-like road agency with clear assignment of responsibilities over the various parts of the network. Build up progressive experience on PPPs from maintenance contracts to concessions. |

Conduct road inventory Use technical assistance Define standards Use technical assistance Select agency staff with legal and financial background |

|

Private sector constraints |

Lack of PPP experience / low PPP skills |

Develop capacity of the private sector (local contractors and consultants) Move from input (quantity) to output (performance) type of contracts. |

Involve road users at all stages of the project Define performance indicators for maintenance Conduct sufficient preliminary studies |

![]() Constraints and Opportunities for PPP Transport Projects. Lahmeyer International GmbH, (1998).

Constraints and Opportunities for PPP Transport Projects. Lahmeyer International GmbH, (1998).

![]() Lifting constraints to public-private partnerships in South Asia: the way toward better infrastructure services, Bhatia and Gupta, PPIAF, Gridlines Note n°6, May 2006

Lifting constraints to public-private partnerships in South Asia: the way toward better infrastructure services, Bhatia and Gupta, PPIAF, Gridlines Note n°6, May 2006